Absolutely! If you don't see it as an option on your account, you'll have to deactivate your return and start over.

To deactivate a return:

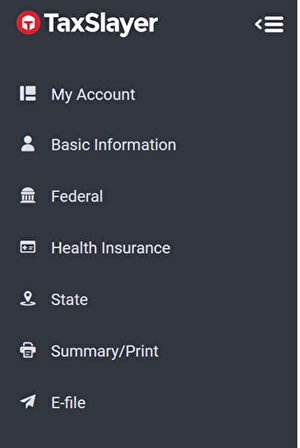

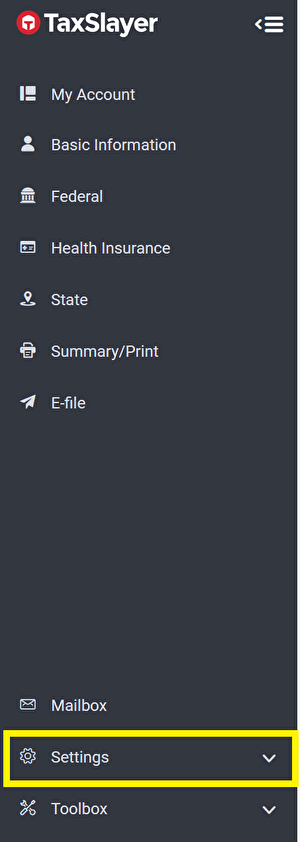

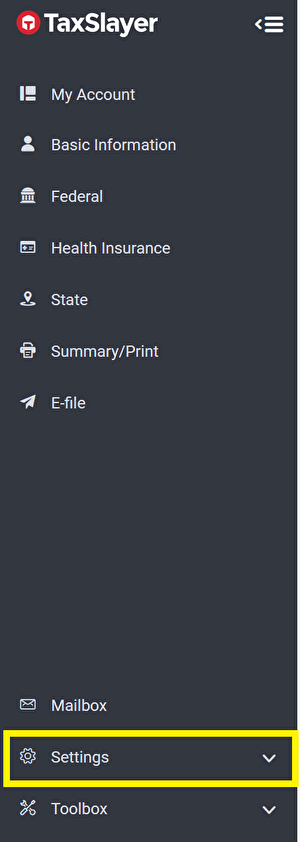

1. Click the "Settings" button on the left hand toolbar.

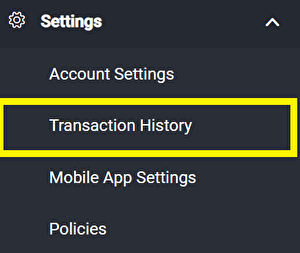

2. Click "Transaction History".

3. Scroll down to "Deactivate your return", select a reason for deactivation and click "clear your return and start over".

You'll be logged out and able to start over again.

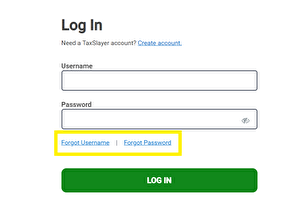

4. Log back into your TaxSlayer account and enter your basic information

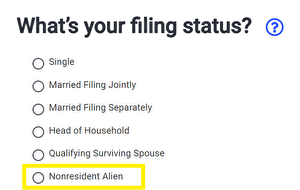

5. When you get to the Filing status page, click "Nonresident Alien", followed by your appropriate filing status.